Tech News

Tech news: FloQast launches AI-driven automation features – Accounting Today

FloQast debuts AI-driven automation features; Settle adds three-way matching for purchase orders; Modern Treasury introduces Professional Services offering; and other accounting tech news.

The IRS Advisory Council is looking for new members, and help with fairness in tax administration.

Accounting Today is in the midst of surveying CPA firms with wealth management practices for this year’s ‘Wealth Magnets’ ranking.

The research will focus on investor needs and build on relevant preexisting initiatives when possible.

Not only are ransomware attacks growing dramatically, 90% of IT decision-makers have made at least one payment in the last year.

How do you charge sales tax when different kinds of digital product are sold together?

Deloitte auditors have been turning their attention to climate risks affecting clients who need to deal with a growing array of regulations and laws.

Accounting Today is a leading provider of online business news for the accounting community, offering breaking news, in-depth features, and a host of resources and services.

Tech News

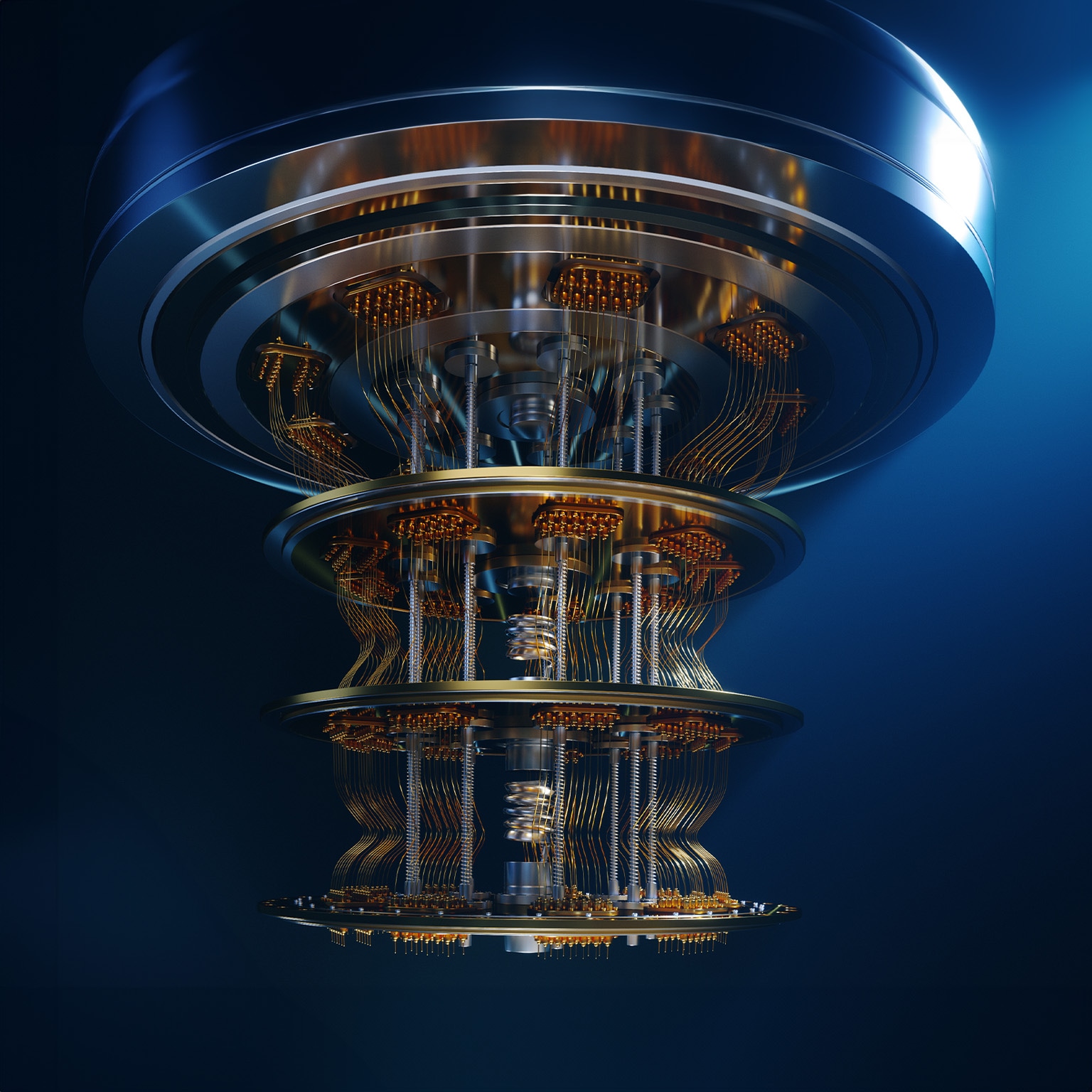

Steady progress in approaching quantum advantage | McKinsey – McKinsey

A year of strong funding coupled with sturdy underlying fundamentals and significant technological advances reflected strong momentum in quantum technology (QT).

Updated McKinsey analysis for the third annual Quantum Technology Monitor reveals that four sectors—chemicals, life sciences, finance, and mobility—are likely to see the earliest impact from quantum computing and could gain up to $2 trillion by 2035 (see sidebar “What is quantum technology?”).

Private and corporate funding for quantum technology start-ups in pursuit of that value, however, took a notable dip. Investments decreased 27 percent from the previous year, with the biggest drop in quantum sensing start-ups. This decline, however, was smaller than the 38 percent decline in all start-up investment worldwide. Notably, the majority of funding (62 percent) went to companies founded five or more years ago, reflecting a shift in investments toward more-established and promising start-ups, with a focus on scaling them.

Quantum technology encompasses three subfields:

In contrast to the private sector, public investments increased more than 50 percent over 2022, making up almost a third of all investments in quantum technology. A range of countries, led by Germany, the United Kingdom, and South Korea, have announced significant new funding for QT development, bringing the global public funding total to date to about $42 billion.

Our research covers the three main areas of quantum technologies: quantum computing, quantum sensing, and quantum communication. The analysis is based on inputs from various data sources, including publicly available data sources and expert interviews. Because not all deal values are publicly disclosed, this research does not provide a definitive or exhaustive list of start-up and funding activities. Minor data deviations may exist as databases are updated.

Underscoring this momentum was continued strong growth in QT foundations. There was a wave of new or enhanced offerings (for example, start-ups that made their quantum computing accessible through the cloud) and significant technological advancements—especially in quantum error correction and mitigation—as well as a small increase in patents filed. In addition, we found a notable increase in quantum technology programs offered by universities, with the European Union taking the lead in the number of graduates in QT-related fields.

In this article, we’ll go into these and other findings in greater detail (for more on the research, see sidebar “About the Quantum Technology Monitor research”).

In 2023, $1.71 billion was invested in QT start-ups, which represents a 27 percent decrease from the all-time high of $2.35 billion in 2022 (Exhibit 1). Nonetheless, the decrease is smaller when compared to the 38 percent decrease for all start-ups globally. The slowdown in the number of new QT start-ups founded continues (13 in 2023 versus 23 in 2022). Deal sizes have decreased as well, with the average deal size being $40 million in 2023 compared to $105 million in 2022 and $107 million in 2021. In line with this development, deal counts dropped to 171 in 2023 from 206 in 2022.

There are several factors causing the decrease in private investment into QT, including a significant shift in focus toward generative AI as well as lingering perceptions of QT being a long-term technology whose potential in various sectors is still being understood and evaluated.

Public funding for quantum technologies, on the other hand, jumped more than 50 percent over 2022. While China and the United States have previously dominated QT public investment, new announcements from Australia, Canada, Germany, India, Japan, the Netherlands, South Korea, and the United Kingdom reflected a growing realization among a broader range of governments of the importance of QT; South Korea and the United Kingdom, in particular, made significant increases to their funding levels (Exhibit 2).

Most of these national initiatives aim to establish technological leadership and sovereignty and spur private investments for quantum technology development. For example, the aim of the United Kingdom’s National Quantum Strategy, which includes $3.1 billion in public funding over ten years, is not only to allow the United Kingdom to be a leading quantum-enabled economy but also to generate $1.3 billion in private investment in quantum technologies.

Where did the funding go? The vast majority of investments have been in US companies (more than two times the amount compared to the next country), followed by companies in Canada and the United Kingdom. The majority of venture capital funding went to scaling up established start-ups, with more than 75 percent of the total investment value going to series B or later funding rounds. This suggests the establishment of more-mature technological platforms for quantum computing and signals investors’ potential risk aversion to early-stage start-ups and unproven technologies or approaches—which also partially explains the 43 percent drop in new start-ups compared to 2022.

Talent development took a notable step forward in 2023, reflecting a positive focus on building QT’s foundations. There were 367,000 people who graduated in 2023 with QT-relevant degrees. Meanwhile, the number of universities with QT programs increased 8.3 percent, to 195, while those offering master’s degrees in QT increased by 10.0 percent, to 55. The European Union and the United Kingdom have the highest number and density, respectively, of graduates in QT-relevant fields. This surge helps explain why scientists from EU institutions contributed most often to quantum-relevant publications.

Building off of this talent and these investments to generate value is still a challenge because of limited access to state-of-the-art hardware and infrastructure, limited awareness and adoption of quantum technologies, and a lack of interdisciplinary coordination (such as between academia and industry) required to bring technologies to market. Collaboration between industry, academia, and government is essential to accelerating development of quantum technology to industrialize technology, manage intellectual property, and overcome talent gaps.

To address this issue, “innovation clusters” are emerging worldwide. These clusters are coordinated networks of partnerships between researchers, industry leaders, and government entities that contribute to the technological advancement of quantum technologies and drive regional value creation (Exhibit 3).

Most clusters share the following elements:

Developing and scaling such regional innovation ecosystems (including research consortiums) will be a determining factor for achieving wide adoption and commercialization of quantum technology.

The past year marked continued advances for all quantum technologies, with a range of enhanced and new QT offerings coming to the market. One advance was the transition from the NISQ1 era to the FTQC2 era. Other key breakthroughs included the following:

For the full set of insights and data, download the entire Quantum Technology Monitor.

Michael Bogobowicz is a partner in McKinsey’s New York office, where Rodney Zemmel is a senior partner; Kamalika Dutta is a specialist in the Berlin office; Martina Gschwendtner is a consultant in the Munich office; Anna Heid is an associate partner in the Zurich office; Mena Issler is an associate partner in the Bay Area office, where Alex Zhang is a consultant; Niko Mohr is a partner in the Düsseldorf office; and Henning Soller is a partner in the Frankfurt office.

Tech News

Capitalizing on technology budgets: A CIO’s story – CIO

In today’s competitive business setting, enterprises are constantly under pressure to maintain profitability amid challenging economic conditions. While traditional approaches to bridging the profitability gap, like layoffs and budget cuts, can harm company culture, an innovative and practical alternative is capitalizing on technology budgets.

By leveraging data-driven methods, businesses can optimize and reclaim operating capital from their extensive technology budgets, reducing expenses without resorting to drastic measures.

Advice from finance leaders often casts a negative shadow on non-finance leaders in budget decisions and planning. However, it’s important to remember that headcount and budget cuts are not the only strategies to streamline costs. Capitalizing on technology budgets presents a viable solution. This strategy enables Chief Information Officers (CIOs) to reduce costs without resorting to layoffs or budget cuts while retaining staff and continuing projects that might be axed.

Tech and tech-adjacent expenditures, including categories like Customer Relationship Management (CRM), cloud and data services, billing, software, network storage, business process outsourcing, telecommunications services, and data center technology, represent significant expenses. This pool is ripe for reduction, resulting in substantial savings.

Recently, I had an in-depth conversation with Tracy Mozena, the CIO of Atlantic Aviation, who shared her journey in navigating technology budgets. Atlantic Aviation, a leader in aviation ground support services, is a compelling case study illustrating the significant financial benefits that organizations can reap from capitalizing on technology budgets.

Tracy ran IT for a management company that owned five businesses and made technology decisions for the group of companies to benefit from economies of scale. The impact of the COVID pandemic triggered the divestment of all those companies, and Atlantic Aviation was the second to last entity sold and acquired by KKR. Tracy came along with Atlantic Aviation after that transaction.

Technology decisions made for the combined five companies weren’t necessarily the best strategy moving forward for Atlantic Aviation after its divestiture. They brought in Deloitte to evaluate the situation, which, after their analysis, recommended quite a bit of outsourcing. Tracy’s team of around 30 people couldn’t support that model.

Atlantic Aviation’s CFO brought in AIQ, whom he had worked with in the past, to evaluate their technology expenditure. Atlantic Aviation’s procurement team, which consists of only two people, is focused mainly on purchasing fuel — the business’ most considerable cost — not on IT. This move deepened Tracy’s initial concern about changing too much too fast. However, she was consistently impressed with AIQ’s data-driven process and the significant cost savings they drove. It convinced her that there was potential for substantial savings. It was encouraging that a small number of technology categories considerably impacted expense savings.

AIQ’s engagement with Atlantic Aviation encompassed a high-level assessment of technology expenditure, identification of technology categories with the highest potential savings, executing numerous procurement auctions, and delivering negotiated contracts ready for execution. Tracy appreciated that cost wasn’t the only focus, but also SLAs and support. She needed to consider the ability of her small team to support and roll out any changes. AIQ even helped them find the right partner at the right price and level of support. Tracy thought the results were remarkable:

Atlantic Aviation’s story underscores several vital points:

When I asked Tracy what advice she would give other CIOs, she said, “Be open to using a company like AIQ. Don’t be resistant to opening up your contracts and costs to inspection. Things change so fast in tech that a decision you made even two years ago might be worth evaluating as competition and pricing dynamics change quickly. Also, you must be willing to do the work after all the negotiations because changing technology in an enterprise is hard work and time-consuming. Don’t bite off more than you can chew.”

By following Atlantic Aviation’s lead and implementing a data-driven approach to technology budget capitalization, enterprises can achieve significant cost savings without sacrificing quality or service. This approach can free up capital for strategic investments that drive growth and profitability.

David Mario Smith is founder and principal analyst at InFlow Analysis. Dave is a Gartner veteran of over 16 years and an IT industry professional with 20 years of experience in the collaboration and workplace technology markets, having helped thousands of enterprises with their collaboration and workplace strategies. Dave’s career spans from being a senior analyst at Gartner to research director and lead analyst at Aragon Research.

Sponsored Links

Tech News

UnitedHealth Group CEO blames hack on aged technology systems – Roll Call

UnitedHealth Group CEO Andrew Witty on Wednesday blamed outdated technology for a hack that likely exposed the health care information of millions of people and crippled claims processing for thousands of providers for several weeks.

During an appearance at a Senate Finance Committee hearing — his first before lawmakers since the Change Healthcare hack in February — Witty noted that UnitedHealth Group acquired Change Healthcare in 2022 and was still in the process of upgrading and modernizing its dated technology when the attack happened.

Senators didn’t buy that explanation. Finance Chair Ron Wyden, D-Ore., accused UnitedHealth Group of failing its customers by not employing widely recommended cybersecurity practices, like multifactor authentication, which requires users to log into systems with more information than just a password.

“I think your company, on your watch, let the country down,” Wyden said. “This hack could have been stopped with cybersecurity 101.”

UnitedHealth Group discovered the attack in late February and took systems offline to prevent malware from spreading. That resulted in thousands of providers being unable to receive payments for claims that are processed by Change Healthcare. Witty also said Wednesday he personally made the decision to pay a $22 million ransom to the hackers.

Witty said Change Healthcare “unfortunately and frustratingly” did not yet have multifactor authentication on its servers despite it being a company-wide requirement at UnitedHealth Group.

“We’re trying to dig through exactly why that server had not been protected by multifactor authentication,” he said. “I’m as frustrated as anybody about that fact.”

And because of the “age of the technology,” backup systems — called “redundancies” — that were intended to mitigate the impact of an attack were also compromised, Witty said.

“Multifactor authentication is vital for prevention, but redundancies… help the company get back on its feet,” Wyden said. “This company flunked both.”

Witty said that as of Wednesday, all external-facing systems have multifactor authentication. It has also hired third parties to review its technology to ensure it is secure against attacks.

“This was some basic stuff that was missed,” said Sen. Thom Tillis, R-N.C., waving a copy of a book titled “Hacking for Dummies.”

Wednesday marked the first time Witty publicly answered questions about the attack. Later, Witty appeared before the House Energy and Commerce Subcommittee on Oversight and Investigations.

The long-term consequences and fallout are still largely unknown, with Witty saying the hack could potentially impact a “substantial proportion” of Americans, though what type of information was obtained is still unclear.

Files obtained by the hackers contained protected health information and personally identifiable information, but there is no evidence yet doctor’s charts or full medical histories were stolen, Witty said.

Witty said he expects UnitedHealth to notify impacted patients within the “next several weeks.”

“We want to try and avoid piecemeal communication and it’s our top priority to get this done just as fast as possible,” he said.

Still, senators pressed Witty to act more quickly.

“Ten weeks is way too long for millions of Americans to not know that their records may be available to criminals on the dark web,” said Sen. Maggie Hassan, D-N.H. Witty said UnitedHealth Group is offering two years of free credit monitoring to potentially impacted patients.

While Witty said claims processing is mostly back to normal, that assertion was challenged by senators who said they are still getting complaints from providers in their states.

“There is a backlog that many of our providers and hospitals have from nine weeks of not being able to get in and make these claims,” said Sen. Marsha Blackburn, R-Tenn.

Witty said that while UnitedHealth is processing payments instantly, other insurers may not pay until 30 days after a claim has been received.

“That would explain why you’re continuing to see that delay,” Witty said, noting providers can still apply for interest-free loans from UnitedHealth that don’t need to be paid back until their cash flows are back to normal.

The attack — considered the largest to hit the U.S. health care industry — has spurred calls for Congress and the Biden administration to implement tougher cybersecurity requirements.

Wyden has said Congress needs to pass minimum cybersecurity requirements for the health care sector. Wyden also said federal agencies need to fast-track new cybersecurity rules for Americans’ private medical records.

“We’re making a huge mistake by not having federal rules of the road on data privacy and data breaches and how these enterprises have to mitigate these things,” Tillis said. “We really got to work on it because now we’ve got a patchwork of over a dozen states that are doing it differently.”

On Wednesday afternoon, the Energy and Commerce Oversight and Investigations Subcommittee covered similar ground but focused particularly on UnitedHealth Group’s large footprint in the health care sector due to decades of acquisitions.

Members questioned whether UnitedHealth Group was taking advantage of the attack’s negative financial impacts on providers to acquire more practices.

Witty replied that the company has only acquired one practice in Oregon — an acquisition that was initiated before the attack.

Still, Rep. Earl L. “Buddy” Carter, R-Ga., railed against the company’s use of vertical integration, in which it has acquired physician practices, pharmacy benefit managers and other players in the health care system.

“Let me assure you that I’m going to continue to work to bust this up,” Carter said. “This vertical integration that exists in health care in general has got to end.”

Several members also took the opportunity to chide United Healthcare’s use of prior authorization, which Witty said resumed for its Medicare Advantage plans April 15.

The company should “carefully review how that prior authorization” has affected patient outcomes, said Rep. John Joyce, R-Pa.

-

General Knowledge2 years ago

General Knowledge2 years agoList of Indian States and Capital

-

General Knowledge2 years ago

General Knowledge2 years agoList Of 400 Famous Books and Authors

-

Important Days4 years ago

Important Days4 years agoImportant Days of Each Month

-

General Knowledge2 years ago

General Knowledge2 years agoCountries and their National Sports

-

General Knowledge3 years ago

General Knowledge3 years agoCountry Capital and Currency

-

Important Days3 years ago

Important Days3 years agoHoli

-

General Knowledge2 years ago

General Knowledge2 years agoList of Indian President

-

General Knowledge2 years ago

General Knowledge2 years agoList of Indian Vice President